Like the majority of people in the UK, I use banking services every day. Whether this be using my credit card, transferring money to a friend after a night out or extending my overdraft (can you tell I’m a student?) the services provided by banks are a fundamental part of my life. Retail bankers play a key role in these front-end services, and it’s likely that all of us at some point have called on the expertise of these individuals to assist with our banking enquiries.

Yet as I sit here, I cannot recall the last time I went to a bank and acquired these services. So how can I be so reliant on these services traditionally provided by retail bankers, yet rarely have to speak to one? The answer lies in the evolution of the digital economy and technologies such as artificial intelligence (AI).

AI is the ability of machines, computer programmes and systems to perform the intellectual and creative functions of a person (Shabbir and Anwer, 2015), and is become increasingly prevalent in front end banking, from fraud detection and credit scoring to chatbots and voice assistants. The video below contains a number of high-profile individuals within the banking and financial services industry talking about the exciting possibilities of AI (Internet of Business, 2017).

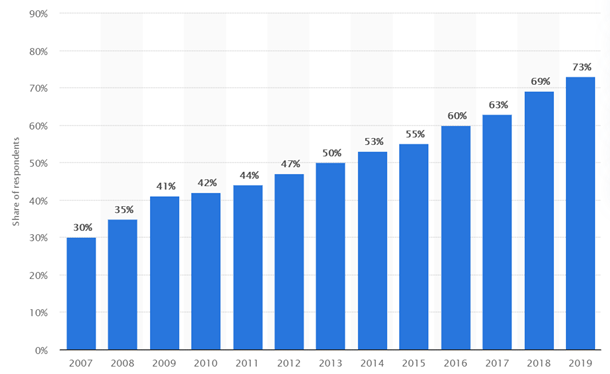

Another huge innovation in banking over the past decade has been the rise of online banking. The scope of features available via online banking is incredible, from simply transferring money to applying for a mortgage, with its evolution seemingly exponential. According to a recent survey, a staggering 73% of individuals in Great Britain regularly used online banking services in 2019, up from 42% in 2010 (Statista, 2020).

The Economist Intelligence Unit report that coping with new technology is a top concern of retail bankers (EIU, 2019), and with these technology-based solutions replacing many branch-specific functions, it prompts the question: do these digital technologies represent a risk to the role of a retail banker?

The View from the Inside

To explore how these digital technologies have changed the role of a retail banker, I spoke to Niall Dewson of NatWest in Bridport. The message was clear: the fundamentals of the job haven’t changed, however the way in which this work is conducted has.

‘A customer may walk in to open a savings account and we help them do it on the app within 5 minutes, or 30 years ago a customer may have come in to make a large withdrawal of cash to pay someone and we would have talked about the benefits of paying by cheque, but now we would show them how to do this online’ says Niall. ‘Digital technologies allow us to streamline the traditional retail banking processes’ he adds.

AI in the form of chatbots has also had a big streamlining effect. The high demands of customer service have long been an issue for retail bankers, so the ability of chatbots to immediately answer questions and give sound financial advice without the customer ever having to speak to another human has helped to relieve some of this strain.

Niall stressed that the time saved due to digital technologies allows for more time to be invested into other responsibilities, such as having more in-depth conversations with those customers most in need of guidance, or undertaking further qualifications such as the personal banker accreditation. Increased popularity of digital technologies has also created new responsibilities for retail bankers due to new threats to customers in the form of hackers and scammers. Retail bankers are now being trained to provide advice for such threats in ‘community banking’ roles, suggesting a switch from a sales-based role to a service-based role.

Looking to the Future

It seems inevitable that the future of retail banking will become increasingly non face-to-face as customers demand the convenience of being able to do what they want, wherever they are, so long as the technology allows for it.

Some reports suggest that US banks could cut more than 200,000 jobs in the next decade (Financial Times, 2019), a worrying prediction for any retail banker. However, these digital technologies could also offer a potential opportunity for the transformation of roles in retail banking.

As banks continue to close their most uneconomic branches, we will likely see a trend towards pop-up and mobile-led banking hubs replacing traditional branches. Retail bankers will have to become more mobile, more technology-savvy and have greater knowledge about all of a bank’s products and services.

Niall tells me that banks have already started to offer more career and training opportunities which focus on developing the skills required to thrive in roles which leverage digital technologies, where specialist knowledge is augmented by digital technologies to provide an optimal service to customers.

The biggest factor which will ultimately decide the future for retail bankers is what the ceiling is for these digital technologies (if there is one), and how long will it take to reach this point. One thing is for certain- the digital revolution has reached banking and is showing no sign of slowing down.

References

Financial Times. (2019). Tech forecast to destroy more than 200,000 US bank jobs. Retrieved February 13, 2020 from https://www.ft.com/content/baf3297a-e456-11e9-9743-db5a370481bc

Internet of Business. (2017, January 10). How Artificial Intelligence (AI) is changing banking [Video file]. Retrieved from https://www.youtube.com/watch?v=MgeQzhZkBJ0

Shabbir, J. and Anwer, T. (2015). Artificial Intelligence and its Role in Near Future. Journal of Latex class files, 14(8), 1-11.

Statista. (2019). Share of people using internet banking in Great Britain 2007-2019. Retrieved February 12, 2020 from https://www.statista.com/statistics/286273/internet-banking-penetration-in-great-britain/

The Economist Intelligence Unit. (2019). A Whole New World: How technology is driving the evolution of intelligent banking. Retrieved February 12, 2020 from https://www.temenos.com/wp-content/uploads/2019/07/EIU-2019-report-2019-Jul-22.pdf

The development of digital technologies does make a huge impact to the bank services. I certainly agree that online banking services made my life easier. As an international student, I have used Santander for five years and I could almost deal with all my issues without going to the bank and speaking to the person. The bank mobile app is great which allows me to check account balance and transfer money to a friend at any time. The new services provided on the app such as chatbot is very helpful which means we can get our answers back instantly. The only problem I would say is it takes a few days for online transactions to show up in my account (not sure if it is Santander only?) which sometimes made me confused about the balance. I could manage my account more effectively if the transactions are present immediately.

LikeLike

Interesting to hear how online banking is so useful for international students. My Natwest account is similar to your Santander account in that it takes a few days for transactions to show up. I also have a Monzo account however, which sends you a notification as soon as you make a payment and shows up on your bank statement immediately. This is similar for other online banks, such as Starling Bank.

Debit card payments take several days to process, and I simply think that traditional banks hide these pending transactions, whereas Monzo/ Starling show them. Let me know if you discover anything more on this topic.

LikeLike

I found your reference to chatbots particularly interesting.

I certainly agree with you that chatbots will be hugely beneficial in terms of relieving the strain on banks branches to cope with the increasing demand of customers.

However, this digital transformation does raise a few questions for me.

The response to these chatbots has been split – only around 35% of customers actually preferred this method to going into the branch and meeting face – face with employees (Chamberlain, 2020)

Personally, I find it unbelievably frustrating, even at the moment, when you ring the bank and have to spend 20 minutes talking to an automated voice just to streamline you to the person who can help. Therefore, I can’t help but be pessimistic about the efficiency and success of chatbots in this industry.

I think that if chatbots are developed further by learning emotional intelligence to engage more with their customers, this advancement might be adopted and enjoyed by all customers.

Reference:

Chamberlain, A. (2020, February 17). How Chatbots are transforming the retail banking customer experience. Retrieved from Yext: https://www.yext.com/blog/2019/03/how-chatbots-are-transforming-the-retail-banking-customer-experience/

LikeLike

I have the same feelings as you, as I always use online banking. For me, it is always a bit dangerous to go out with some cash, and it is not very convenient. Undoubtedly, online banking is a significant measure for convenience people.

Your article is persuasive and shows ample information from almost a first perspective. However, I still have some doubts. If people rely heavily on online banking, can their privacy be guaranteed? Are large electronic deposits vulnerable to theft? If a bad guy hacks into an online account, our money will be easier to steal than before. This is also what I think is the most disturbing aspect of the development of AI. Can you discuss these issues? Thank you.

LikeLike

Hi Ellis. I found your post very relevant and insightful. I specifically like your section on, “The View from the Inside”. You share that NatWest employee, Niall states; “The message was clear: the fundamentals of the job haven’t changed, however the way in which this work is conducted has”. This resonated with me as I did my blog post on Collegiate Recruiting, specifically from a sports inside look. And I feel like you hit the nail on the head with the statement above, “The message was clear: the fundamentals of the job haven’t changed, however the way in which this work is conducted has”. In some ways, that fits so well into the role of college coaching and recruiting. The job is to recruit the best athletes to your specific university. The way in which you do that job and the role you now play in making that happen has changed. Why you ask? For the same reason banking has seen a shift. Technology and what that means, looks like, and allows for. I think you transition the post well when you go from ‘The Inside Look’ to ‘Looking to the Future’ and what that could mean for banking. We have to ask the questions and we have to ponder the changes because otherwise we may be left feeling like we are behind, and let’s face it- no one wants to be technologically left in the dust.

I do have one question to raise when looking to the future and what that could look like in banking terms. Do you think ‘pop up banks’ and ‘mobile locations’ will stick? Do you think the flexibility and the lower overhead costs that would certainly accompany smaller venues, and less staff- outweigh and ultimately outlast the need for face to face and human interaction provided by a more formal experience that ‘banking’ has always been known for?

It is interesting to think about. But then again, I imagine, at one point, so was the idea of a machine allowing for a personalized card to be inserted and bank notes from a specific account pop out, having been directly debited from a person’s account. With no entry into an actual bank required to get one’s cash.

Technology. It’s amazing. Now, can we keep up?

LikeLike

Hi Ellis! I found your post very relevant and insightful. I specifically like your section on; ‘The View from the Inside’. You write that NatWest employee Niall states; “The message was clear: the fundamentals of the job haven’t changed, however the way in which this work is conducted has”. This resonated with me as I did my blog post on Collegiate Recruiting, specifically from a sports Inside Look. And I feel like you hit the nail on the head, with the statement; “The message was clear: the fundamentals of the job haven’t changed, however the way in which this work is conducted has”. In some ways, that fits so well into the role of collegiate recruiting. The job is to recruit the best athletes to your specific university. The way in which you do that job and the role you now play in making that happen has changed. Why you ask? For the same reason banking has seen a shift. Technology and what that means, looks like, and allows for. I think you transition the post well when you go from the inside look to the future and what that possibly means. We have to ask the questions and we have to ponder the possibilities, because otherwise we may be left feeling like we are behind- and let’s face it, no one wants to be technologically left in the dust.

I do have one question to raise when pondering the future and what that looks like for banking. Do you think ‘pop of banks’ and ‘mobile locations’ will stick? Do you think the flexibility and the lower overhead costs they certainly allow for, will outweigh and outlast the need for face to face and human interaction? So much of banking of the past was the idea of the ‘experience’ that accompanied visiting a branch, and more specifically ‘your branch’. It was personal. Are we moving towards informal and fast over formal and intentional?

It is interesting to think about. But then again, I imagine, at one point- so was the idea that a machine you used a personalized card with, could be inserted and have money be directly delivered to your hands from your personal account, in seconds. Fast and immediate. No entry into a bank required.

Technology. It’s amazing. Can we keep up?

LikeLike

Very interesting read. Last year I attended a conference about the future of financial services and the speakers on the panel focusing on retail banking have also said that despite of the technological advances, growing popularity of Fin Techs and AI, we still need banks, just the roles within them might change. However, even though the future of banks is safe, what about the employees working in branches? From what you’ve said, they need to develop a new skillset to advice customers on technological matters, but since AI increases efficiencies and lowers the number of people in need of face-to-face assistance, does that mean a lot of retail bankers can expect to loose their jobs due to automation?

Additionally, I particularly enjoyed how you used other media, i.e. the video, and done some field research yourself – that definitely added a lot of value to the post. Being quite interested in how digital economy is transforming financial sector, I have wrote a post about the changing nature of roles within asset and wealth management – maybe you’d want to give it a read?

Thanks,

Agata

LikeLike