For far too long, banking has been harder than it needs to be. From pesky hidden fees and charges to the stress of managing your accounts, the days of traditional banking methods are outnumbered. The opportunity for a newcomer to disrupt the norms had presented itself. An opportunity that Monzo has seized with both hands.

Their mission? To make money work for everyone. Their product? A banking hub that lives entirely on your phone. Their customer base two years ago? 500,000. Their customer base now? Almost 4 million.

Founded in 2015, Monzo is a UK-based challenger bank making real strives in the industry. I opened my account roughly one year ago and haven’t looked back since. There are a number of attractive features, from the absence of fees when exchanging foreign currencies to the sheer simplicity with which I can manage my money. All of these features are underpinned by one glowing factor: Monzo’s ability to leverage digital technologies.

Is it actually a bank?

Technically, yes. Monzo obtained their full UK banking license in 2017. But practically speaking, they operate nothing like a traditional bank. They are a ‘challenger bank’, operating in the margin between an online current/savings account and a financial planner, a new breed of technology-driven and customer-centric institutions (Burnmark, 2016).

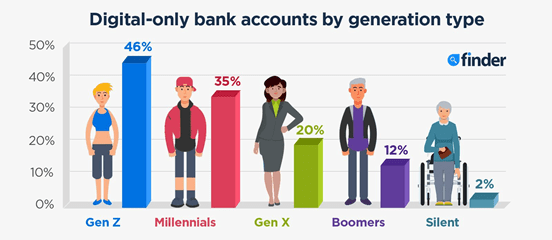

The rising popularity of challenger banks has been driven primarily by Gen Z and Millennials, with one in three Millennials stating that their primary banking relationship is with a challenger bank (Kearney, 2020).

The digital perspective

The driving force behind Monzo’s success is the decision to be completely digital. Face-to-face interaction has always been a pivotal part of the traditional banking service, however as outlined in my previous blog, times are changing.

Going completely digital and leveraging the digital technologies at their disposal has resulted in numerous efficiency-increasing and cost-reduction opportunities. These opportunities have presented themselves in two key areas: automation of services and the migration of front-end activity to digital channels, such as via the implementation of machine-learning and artificial intelligence, which has reduced the requirement for a large customer service team.

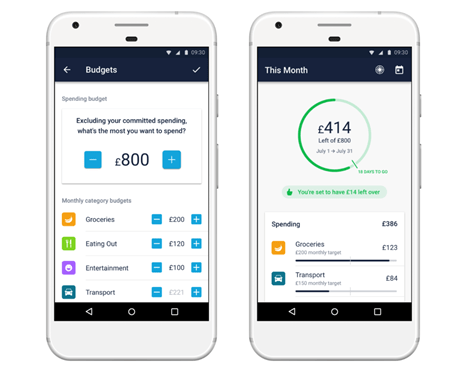

Artificial intelligence is used at Monzo to constantly look for opportunities to improve user experience, an area in which Monzo place a huge emphasis. The Monzo app is a perfect demonstration of this. From this hub, a number of slick features are available. Unlike most banks, your balance is instantly updated, and you receive a notification when you spend, making it easier to track balances. The easy-to-use budgeting tool and option to temporarily freeze your card gives you the ability to complete traditionally laborious tasks at the tap of a button. These user experiences are incomparable and barely scratch the surface of what Monzo offers.

Offering what traditional banks can’t

Chief Executive Tom Blomfield suggests that banking behemoths such as HSBC and Barclays are crippled with outdated technology and principally focus on their existing set of financial products (CNBC, 2020). Traditional banks have certainly been slow to adopt the call from the banking community for greater digital features.

In contrast, Monzo has embraced this change which has paid dividends. Until recently, every customer resulted in a loss due to services free overseas cash withdrawals. However, in their 2019 annual report, it was detailed how the annual per-customer contribution margin is now a £4 profit (Monzo, 2020).

Unrivalled customer experience

From day one, customer centricity and transparency have been heralded as two key areas of focus for Monzo. A democratic culture has been established at the company, and Monzo have used their online presence to encourage customers to share suggestions and engage with the company via its blog and social media accounts. The Monzo community has therefore been involved with numerous important decisions, such as deciding the pricing method for ATM fees abroad (Monzo, 2017) and even providing name suggestions when Monzo had to legally change their name from Mondo (Monzo, 2016).

This hasn’t gone unnoticed by the customers. Monzo have set up a number of crowdfunds in recent years to raise crucial funds, where the community have given back for the faith that Monzo place in their users. Monzo also achieved a customer score of 82% in Which’s ‘best bank for 2020’ survey, trumping the scores at any high street bank (Which?, 2019).

Sustainable banking

As a start-up, innovation and evolution are crucial for success, especially in a crowded market where Monzo are competing not only with traditional banks, but also other challenger banks. Monzo recently transitioned from an outsourced faster payments gateway to an in-house faster payments connection, meaning that 100% of their technology is now hosted in-house. This is indicative of the innovative culture at Monzo.

Monzo’s ultimate goal is to become a sustainable, all-encompassing financial storefront which removes the hassle of routine financial chores. Current features being explored include being able to check your credit score and further development of tools for dealing with your salary, all of which are set to revolutionize the banking sector. Blomfield certainly has impressive plans for the company, and if the success of the last five years is anything to go by, exciting times lie ahead.

References

[1] ‘Challenger Banking’, Burnmark, 2016. [Online]. Available: http://burnmark.com/uploads/reports/Burnmark_Report_Oct16_ChallengerBanking1.pdf. [Accessed: 01 March 2020].

[2] ‘Challenger banks: how convenience, innovation and trust will shape tomorrow’s banking’, Kearney, 2020. [Online]. Available: https://www.kearney.com/financial-services/article?/a/how-convenience-innovation-and-trust-will-shape-tomorrows-banking. [Accessed: 01 March 2020].

[3] ‘Big banks are set up to ‘kill’ change, says founder of $2.5 billion fintech firm Monzo’, CNBC, 2020. [Online]. Available: https://www.cnbc.com/2020/02/10/monzo-ceo-tom-blomfield-big-banks-are-set-up-to-kill-change.html. [Accessed 02 March 2020].

[4] ‘Monzo Bank Limited Annual Report and Group Financial Statements’, Monzo, 2020. Available: https://monzo.com/static/docs/annual-report-2019.pdf. [Accessed 02 March 2020].

[5] ‘ATM Fees Abroad: Asking the Monzo Community to Decide Pricing’, Monzo, 2017. Available: https://monzo.com/blog/2017/09/13/atm-fees-abroad. [Accessed 03 March 2020].

[6] ‘Mondo is now Monzo!’, Monzo, 2016. Available: https://monzo.com/blog/2016/08/25/monzo. [Accessed 03 March 2020].

[7] ‘Britain’s best bank accounts revealed- and those you should avoid’, Which?, 2019. Available: https://www.which.co.uk/news/2019/11/britains-best-bank-accounts-revealed-and-those-you-should-avoid/. [Accessed 03 March 2020].

Hi Ellis.

Thank you for your blogpost on the rise of “challenger” banks in the UK, specifically Monzo. As you point out, Monzo has made huge strides since it was founded in 2015. Like many of these new banks, its key differentiation from its traditional counterparts is its entirely digital offering/footprint without any “bricks and mortar” presence. Moreover, it has exceeded expectations with 3 million customers.

However, you write that “exciting times lie ahead for Monzo”. While I would argue there is some truth to this based on recent growth figures and long-term demographic trends. I wonder if you had considered that a key stumbling block for the bank is customer loyalty (Kelly, 2020, para.8). In order to genuinely “challenge” the behemoths, as you call them, Monzo needs to encourage its users to bank exclusively with them rather than as an “add-on” to their main account with a traditional bank.

References

Kelly, J. (2020). Fintech users just can’t get enough of traditional banks. Financial Times. Retrieved from https://ftalphaville.ft.com/2019/12/18/1576674529000/Fintech-users-just-can-t-get-enough-of-traditional-banks/

LikeLike

Hi Ellis,

Thanks for sharing a prime example of challenger banks and I do like your article. I must say Tom Blomfield and his team are very smart and innovative to develop such a digital-only financial operating platform by using machine-learning and artificial intelligence. They design an app as a shop front and make it appeal particularly to younger generations who are used to live with a smartphone. No wonder the number of customers has increased by 8 times within 2 years. I also found services provided by Monzo are truly customer-friendly – as you said, we can set budgets as well as notifications of money outflow, which is exactly what I value since I start cooking by myself. I have heard that it can even offer the option to save spare change into a separate pot automatically.

But in this year Monzo was reported to have received a long list of complaints from dissatisfied customers who claimed that their accounts have been frozen for no apparent reason https://www.theguardian.com/money/2020/jan/18/monzo-account-freeze-app-fraud. Seemingly, Monzo still has a way to go before standing firm. But considering its high-tech innovation ability, let’s look forward to the future.

LikeLike

Hi Ellis,

This post is really interesting and on a topic which my friends often attempt to convince me to convert to. One area of Monzo as a company that I would have found really interesting to hear more about is how sustainable their business model is going into the future. The statistic that they now make money on every customer in year 4 is a great sign for their company, but at £4m in operating profit that is roughly £1/customer. Given Monzo is now valued at £2bn seeing whether this is an example of over-inflation for an interesting concept or an accurate representation of their growth potential would be fascinating.

Monzo have been growing their business account numbers over the last year in an attempt to broaden the service on offer to customers and I think this is the next big step for them to take. As of June 2019 there were 15,000 customers on the waitlist for such accounts, showing a demand for the product (Cully, 2020). The question is can they replicate the service that traditional banks offer. Business accounts are a much bigger challenge than current accounts, given the infrastructure and network that the more traditional banks have in these areas. For Monzo to break into this area on a big scale I think they will need to come up with some revolutionary technology to convince businesses of its viability.

Reference List

Cully, J. (2020). Retrieved 10 March 2020, from https://monzo.com/blog/2019/06/24/business-banking-update

LikeLike

Interesting read Ellis. I enjoyed reading about a bank that I have personal experience with.

I liked your point regarding the popularity Monzo has with the Millennial and Generation Z banking customer segments. While doing my own research on why Monzo has become so successful, I read that while Monzo were developing their business, they would encourage users to share suggestions for features they’d like to see through an online forum. Monzo also engaged in discussions on Twitter (Bloomfield, 2018). As we are all aware, the most active users on social media and online tend to be those of the Millennial and Gen Z age. Do you think Monzo intentionally focused on these generations as they recognised these users would be the most excited about digital banking?

One thing I am not keen on with Monzo, is that when a user is travelling, their first £200 withdrawal is free of charge, however any withdrawal after this initial £200 is charged at the similar rate of 3% (similar to traditional banks like Lloyds and HSBC). I personally found this a pain when I went travelling around South East Asia, and was being charged 3% on withdrawals, very quickly after my first lot of £200 was spent. Monzo’s closest rival’s Starling Bank offer all foreign ATM withdrawals free of charge, no limit (Finder.com, 2020). Young people (Monzo’s customers) are the most likely to travel to foreign countries for long periods of time compared to older people, therefore with Starling offering attractive foreign withdrawal conditions, do you think it is Monzo should consider doing themselves?

Bloomfield, K. (2018) Monzo: The Rise and Rise of the Coolest Challenger in the Class. Retrieved 10 March 2020 from: https://thefintechtimes.com/monzo-challenger/

Finder.com. (2020) Starling vs Monzo. Retrieved

LikeLike

^Finder.com. (2020) Starling vs Monzo. Retrieved 10 March 2020 from: https://www.finder.com/uk/starling-vs-monzo

LikeLike

Hi Elli,

I paticularly agree with you that the key to Monzo’s success of completely digital is customer-centric service. Specifically, customers learn more about the value of the company from the online community in the process of interacting with the company and then they share the company’s services with others, which increases both customer loyalty and brand image. (Candace, 2016)

But I think the key to customer-centric service is to adopt different ways to different customers. Although it is inevitable for banks to constantly developing technology of the application tools when facing millennial customers, the more important thing for the banking industry is the efficiency of communication with customers when serving Baby boomers. So maybe in the future, Monzo can focus on optimizing artificial intelligence technology to better help technically backward customers solve problems caused by new services instead of forcing them to face new services all the time.

Reference List

Candace H. (2016). The Importance of Building an Online Community. Retrieved from

https://www.business2community.com/online-communities/importance-building-online-community-01720478

LikeLike